New York Itemized Deductions 2024 Form – You can claim itemized deductions on your New York tax return regardless of whether you do so for federal purposes. New York allows deductions for such expenses as: You can claim New York’s . Stay updated on the standard deduction amounts for 2024, how it works and when to claim it. Aimed at individual filers and tax preparers. .

New York Itemized Deductions 2024 Form

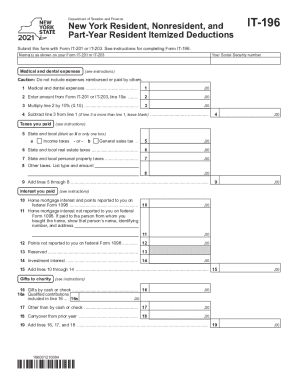

Source : www.tax.ny.gov2017 2024 Form NY DTF IT 203 D Fill Online, Printable, Fillable

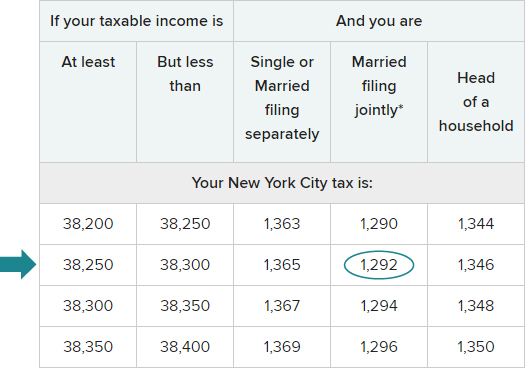

Source : it-203d.pdffiller.comTax tables for Form IT 201

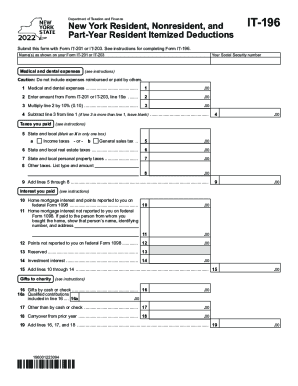

Source : www.tax.ny.govNY IT 196 2022 2024 Fill and Sign Printable Template Online

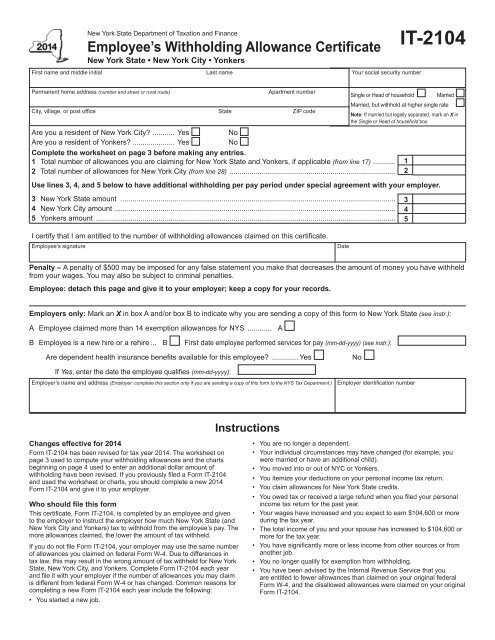

Source : www.uslegalforms.comForm IT 2104 New York State Tax Withholding South Colonie

Source : www.yumpu.comNY IT 196 2021 2024 Fill and Sign Printable Template Online

Source : www.uslegalforms.comNew York Security Deposit Laws: What’s new in 2024 | PayRent

Source : www.payrent.comForm IT 272 Claim for College Tuition Credit or Itemized Deduction

Source : www.dochub.com2024 Tax Update and What to Expect

Source : sourceadvisors.comW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.comNew York Itemized Deductions 2024 Form Form IT 2104 Employee’s Withholding Allowance Certificate Tax Year : With tax season underway, you’ll need to know the standard deduction amount you can claim for 2023. The standard deduction amounts tend to increase slightly each year to adjust for inflation. Let’s . Every dollar you win from gambling should be reported to the IRS, otherwise you could be fined or even go to jail. .

]]>